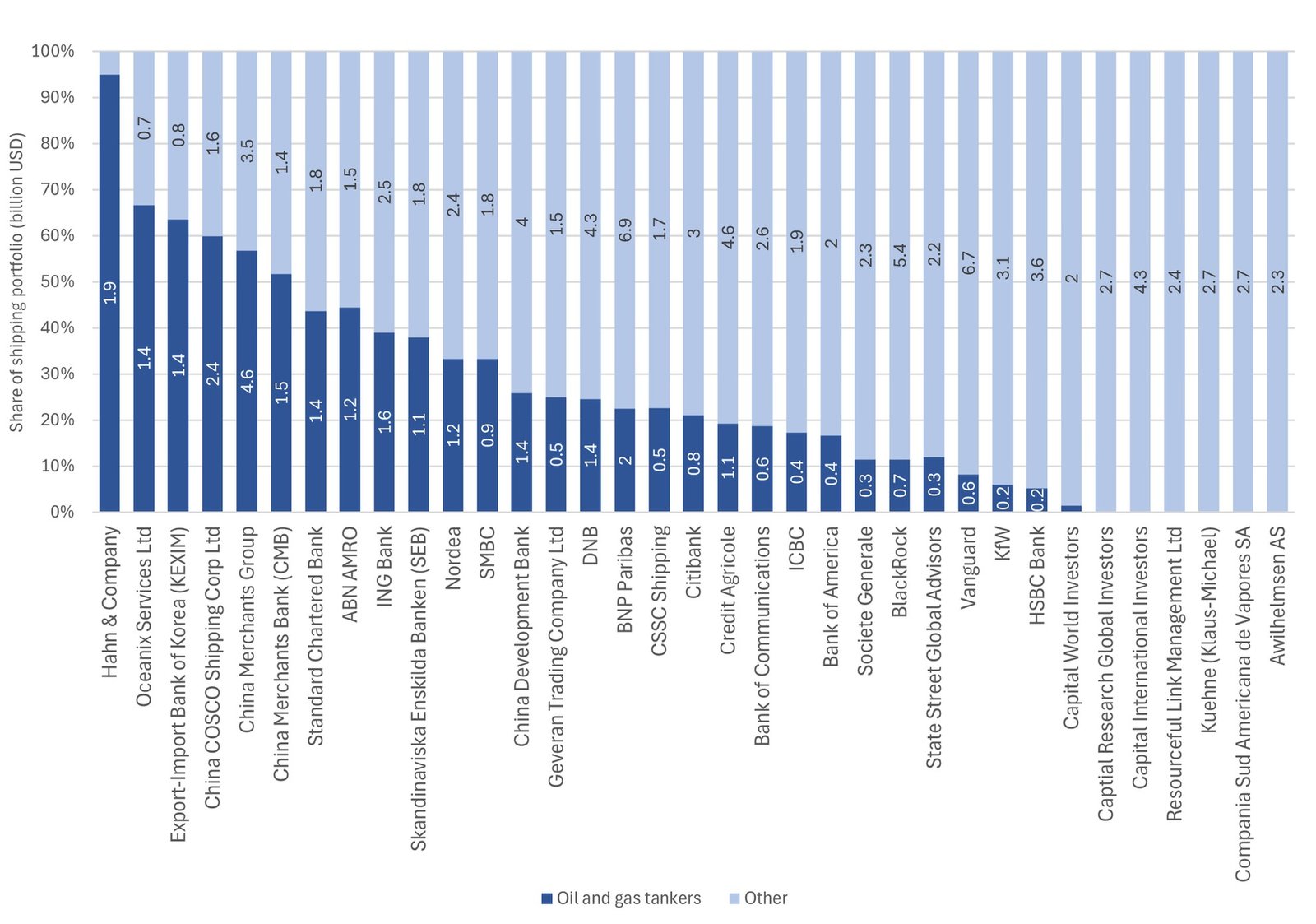

Korean and Chinese financiers have over half of their shipping portfolios tied to oil and gas carriers, most at risk of becoming stranded assets in the global shift to low-carbon energy, according to a new study by University College London (UCL).

European lenders, including Standard Chartered, ABN AMRO, ING Bank, SEB and Nordea, also have more than one-third of their portfolios exposed to fossil fuel shipping.

The study, which mapped USD 378 billion of maritime assets—around 30% of the global fleet value—found that five financiers, including China Merchants Group and Korea Eximbank, hold more than half of their shipping exposure in fossil fuel carriers.

BNP Paribas, the largest financier in the dataset, was found to have nearly a quarter of its USD 9 billion portfolio invested in oil and gas shipping.

Researchers warned that vessels transporting fossil fuels could become “stranded assets” as global demand declines to meet Paris Agreement climate goals. Gas carriers and oil tankers were identified as the most exposed segments, with LNG carriers facing the highest risk due to their specialised design and limited potential for repurposing.

“To our knowledge, this is the first attempt to map climate risk to shipping financiers’ portfolios,” said Dr Marie Fricaudet, Senior Research Fellow at UCL. “Many financiers have a substantial part of their portfolio linked to fossil fuel transportation, highlighting the need for more transparency to anticipate and price-in climate risk.”

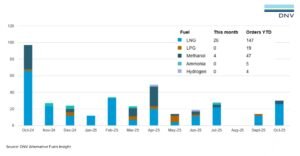

The analysis shows loans account for more than half of LNG carrier financing, followed by leases and equity, while oil tanker financing is more evenly split across equity and loans. This indicates that the financial risk extends beyond banks to global capital markets.

Dr Tristan Smith, Professor of Energy and Transport at UCL, added that with the IMO’s Net Zero Framework delayed, “understanding and managing this risk will now be of greater importance than ever.”

The UCL team has also launched an online tool, the Investment Risk Monitor for Fossil Fuel Carrying Ships (shipping-transition.org), offering scenario-based insights into potential oversupply and valuation risks across oil and gas carrier segments. Findings suggest LNG carriers, in particular, could face significant write-downs over the coming decade.