ABS Chairman and CEO Christopher J. Wiernicki has called on the IMO to “take a timeout” on its net-zero framework, arguing that the industry needs a regulatory approach that “marries ambition with reality.”

Speaking at the launch of the 2025 ABS Sustainability Outlook, Beyond the Horizon: Vision Meets Reality during London International Shipping Week, Wiernicki warned that current pathways to decarbonisation are unclear.

“Shipping and the IMO are on different trajectories.

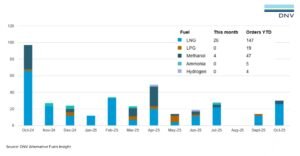

“There is no clear pathway for green fuel availability, scalability and infrastructure support. LNG and biofuels are mission-critical to any success and should not be overlooked, over-penalised or discarded in the Net Zero regulation. Quite frankly, achieving net zero for shipping by 2050 looks like a wildcard,” he said.

“The industry needs a framework but we need one that marries ambition with reality.

“The mechanics need to be thought through. Right now, we are not where we need to be. Emissions remain 121 percent above the 2008 baseline, compliance costs are compounding, and the signals shaping investment – regulation, fuel pricing, penalties, availability, scalability – are moving at different speeds. The IMO needs to take a timeout. We need to get this right.”

The Outlook shows that, while carbon intensity has improved, absolute emissions continue to rise. It also models the sharply increasing cost of compliance, with the daily operating costs of a typical vessel trading within the EU projected to rise from about $15,000 in 2028 to around $45,000 by 2035.

Wiernicki described maritime decarbonisation as a “three-part calculus: 70 percent fuel selection, 15 percent energy efficiency, and 15 percent performance optimisation.” He highlighted the immediate gains possible through software and optimisation while green and blue fuel supply remains limited.

Looking ahead, he urged the sector to “protect the bridge” — LNG with methane-slip controls and bio-/e-LNG pathways — while extending the “runway” with energy efficiency and onboard carbon capture, preparing for the “endgame” of nuclear and zero-carbon fuels once they become viable at scale.

The Outlook also points to a potential retrofit capacity crunch at shipyards in the years ahead, while noting the game-changing potential of nuclear propulsion beyond 2035.